Import Deduction Data

Human Resources > Payroll Administrator Tasks > Import Deduction Data

Use this three-page import wizard to import deduction amounts from a third-party system to Workforce Administration.

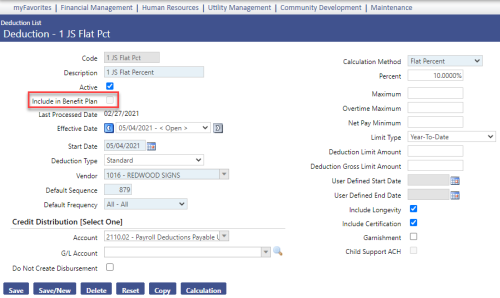

The import process works for stand-alone deduction codes. To tell whether a deduction code is stand-alone, navigate to Maintenance > Human Resources > Deductions and Benefits > Deductions > Code. The Include in Benefit Plan check box should be unmarked:

Prior to New World patch 2022.1.4, the import wizard had one Effective Date field, requiring multiple import files to be created if multiple employees had multiple effective dates. Since patch 2022.1.4, a new Effective Date field lets you populate whatever date you want for each employee.

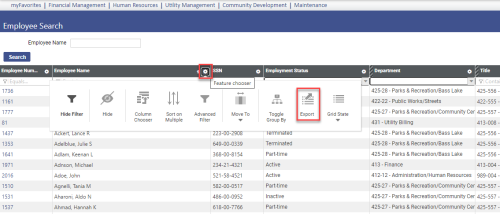

Using the Feature chooser at the top of any column to export to Excel, you may pull a list of employees from the Employee Search list in Workforce Administration, find a common denominator and filter out the employees to be excluded from the import. Some users leave employee names and numbers in the file until they are ready to import, then delete the column with the employee names:

Use the first page of the wizard to define the import. The table below contains descriptions of the fields on this page.

| Field | Description | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Import Type |

Required. Format of the file to be imported. Click in the field to select from a drop-down list of available types. Select Standard to use the standard comma delimited (.CSV) file format. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Date | Required. Date to be used as the start date when the deductions are added to the employees. Click in the field to select the date from a pop-up calendar, or type the date directly in the field. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Import File |

Required. Tells the path to the file you are importing. Click the Browse button to select the file, or type the path directly in the field. One line in the import deduction file equates to one employee deduction record. The file must be comma delimited (ends in .CSV), with a minimum of the deduction code and employee number filled in. The fields in the file are as follows:

Example:

Note: If the Override Amount/Percent or Override Limit is 0, the existing deduction is stopped. If either entry is blank, the default from the deduction code is used. If the deduction code does not have a default and an override is not entered, the record is not imported. Note: Garnishments require additional data and must be entered through Workforce Administration. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Description | Required. Free-form description of the import. |

Note: To reset entries to the way they were when the page last was opened, click the Reset button.

After making your entries, click the Next button to validate the data and open the second page of the import wizard.

This page displays a summary of the initial processing of the import file, including the details of any formatting omissions and data errors that have been detected.

The Import Summary section tells how many deduction records have been processed, how many of those records contain errors and the total number of records that are valid for import.

The Deduction Data Validation Errors section contains a grid of all error numbers and messages, error sources and types.

| Error | Cause |

|---|---|

| Unable to find employee number 999. | Employee number does not exist. |

| Unable to find employee number abc. | Employee number is a non-numeric character. |

| Deduction not found: xxx. | Deduction code does not exist. |

| Override value is invalid. | Amount/Percent contains a non-numeric character. |

| Override limit is invalid. | Limit contains a non-numeric character. |

| Deduction "abc" only may be used during benefit plan enrollment. | Deduction code is marked, Include in Benefit Plan. |

| Deduction "abc" cannot be used because it is marked as inactive. | Deduction code is inactive. |

Note: If you receive an error that says the "Distributed Transaction Manager (MSDTC) has been disabled," your IT department needs to enable DTC on the Web server where New World ERP is installed.

In the Processing Options section, you may check any of the following:

| Check Box | Description |

|---|---|

| Import Deduction Data | Imports deduction records that have been deemed valid for import (see Import Summary section). This check box is checked by default. |

| Print Edit Listing | Generates a listing of the records that have been deemed valid for import and sends it to myReports. This check box is checked by default. |

| Print Error Listing |

Generates a listing of Deduction Data Process Errors associated with the import and sends it to myReports. This check box is checked by default. Note: Data validation errors are not printed. |

After reviewing the information and making your selections, click the Finish button to import deduction data to the database and open the third and final page of the import wizard.

This page displays the general results of the import, according to the boxes you checked on the second page. It tells you whether deduction records have been imported, whether errors have occurred and whether any lists have been generated and sent to myReports.

| Error | Causes |

|---|---|

| The copy option may not be used while checks are in the printed status. | Employee is in a pay batch with a status of Printed. |

| Invalid end date. End date must be greater than or equal to 5/16/09. | Employee is in a pay batch with a status of Posted (Last Used Date is greater than today). |

| Start date cannot be before the deduction code effective date. | Employee start date is prior to the deduction start time. |

| Override amount is required when the default value is zero. | If the deduction master does not have a default amount and the calculation method is Flat Amount, the import file must have one. |

| Override percentage is required when the default value is zero. | If the deduction master does not have a default percent and the calculation method is Flat Percent, the import file must have one. |

| The sequence number already exists for the employee and the date combination | Default Sequence on the deduction exists on another deduction. |

| The effective start date must occur before the effective end date. | Employee is in the import file twice. |

If you want to re-import the file or import a new file, click the Reset button. You are returned to the first step of the import wizard.